Teachers Pensions Advisory Service

For years, the St. Louis school district has experienced the convergence of two trend lines school superintendents hope never to see: rising employee-pension costs and falling student enrollment.

For years, the St. Louis school district has experienced the convergence of two trend lines school superintendents hope never to see: rising employee-pension costs and falling student enrollment.

Despite years of fully funding its share of the teacher-pension plan, the proportion of the St. Louis district's budget tied up in paying benefits for its teachers now makes up about 10 percent—a factor that, coupled with other rising costs, is fueling ongoing cuts in this beleaguered district.

"They are tough decisions that have to be made, because they are about the survival of the entire district, " said Kelvin R. Adams, the superintendent of the 22, 500-student district. "There are no easy decisions anymore in public education."

St. Louis' situation has resonance far beyond the city, because its troubles are similar to those that other districts are likely to face.

Across the nation, states have about $325 billion in unfunded pension liabilities, much of which could be passed along to districts. And, experts note, there are a limited number of ways to handle that debt—cutting services, raising taxes, or trimming benefits, none of which is particularly palatable.

"The default mechanism is service cuts, so fewer education dollars make it into today's classrooms because they are needed to pay for teachers' past service, " said Joshua B. McGee, the vice president of public accountability at the Houston-based Arnold Foundation and an expert on teacher-pension systems. "The real difficulty is finding a solution that is fair to both workers and taxpayers."

In St. Louis, many of the cuts have been shaped with input from the city teachers' union. Changes to the pension structure haven't yet been made, but they have been proposed, and more are likely to be on the table in the future.

"The current system is no longer sustainable by the district, " said Steven R. Carroll, the school system's lobbyist in the state capital.

Costs Rise

The Public School Retirement System of the City of St. Louis, or PSRS, was established in 1944. It predates the state teacher-pension plan serving teachers in all other Missouri districts except for Kansas City. (It is relatively rare for cities to have their own teacher-pension systems; only a handful, including St. Louis, Denver, and Cleveland, do.) The limited size of the St. Louis plan offers an unusual vantage point into the complicated relationship between pension benefits and bottom-line budgeting.

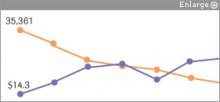

K-12 student enrollment in St. Louis has fallen even as pension costs have begun to skyrocket. They make up about 10 percent of the district's spending.

The district's share of pension costs rose from about $14 million in 2006 to approximately $28 million by 2013, even as K-12 student enrollment fell by 10, 000 students.

You might also like

IIFL Holdings jumps on receiving Sebi nod for investment advisory services — Business Standard

With this, IIFL Holdings would be offering a wide range of investment and financial advisory services to corporate and institutional clients.

Sarah Oberhofer Joins Brookfield Office of Ameriprise Financial — Brookfield Elm Grove Now

Brokerage, investment and financial advisory services are made available through Ameriprise Financial Services, Inc. Member FINRA and SIPC. © 2014 Ameriprise Financial, Inc. All rights reserved.

Capital Intelligence Raises the Ratings of Gulf Finance House BSC — MENAFN.COM

Being a wholesale entity, the company has no official lender of last resort.

Fleet Services is a motorway service station on the M3 near Basingstoke. It is owned by Welcome Break. It was originally built in a Scandinavian style and in 1992 won "Loo of the Year". Before 2001, when Winchester services opened, it was the only service station to exist on the M3. In 2006 it was one of the first service stations to carry the...

Fleet Services is a motorway service station on the M3 near Basingstoke. It is owned by Welcome Break. It was originally built in a Scandinavian style and in 1992 won "Loo of the Year". Before 2001, when Winchester services opened, it was the only service station to exist on the M3. In 2006 it was one of the first service stations to carry the...