Enterprise Risk management implementation

Strong ERM programs can help energy and utility companies effectively manage risk

Strong ERM programs can help energy and utility companies effectively manage risk

The content of this blog post is based on a live webinar which took place on February 4 with distinguished speakers: Gregory E. Aliff, Senior Partner, Energy & Resources, Deloitte LLP and Dr Brenda Boultwood, Senior Vice President of Industry Solutions, MetricStream.

The fundamental tenants of the electricity business in the U.S. include safe, reliable, compliant, affordable and environmentally friendly. The source of electricity generation spans coal, natural gas, nuclear energy, renewable energy and oil. To forecast the future price of natural gas renders any other fossil fuel and nuclear source unviable for electricity generation. Also, the renewable energy portfolio standards place a focus on solar, wind and energy efficiencies, regardless of the associated economics.

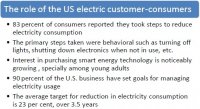

The aforementioned statistics are based on the findings of Deloitte resources 2012 Study.

With rising electricity costs, power consumption has lowered significantly. However, this has yielded a peculiar situation wherein the cost of units consumed per kilo watt hour (kWH) has actually increased. The question remains if the price charged to individual consumers will invoke higher end-user investment towards energy efficiency.

The main disruptions to the energy and utility business model are the declining demand for electricity and technology advances witnessed in renewable and storage energy efficient products. In the coming days, California and New England are tipped to face business disruption, and electric companies will have to adopt both defensive and offensive strategies to combat this. The future focus will center on developing technologies, particularly solar and storage energy.

The need of the hour is for energy and utilities to build a robust risk management program. A single system can drive collaboration among different units and processes, and integrate the end-to-end risk assessment process. These developments can streamline and facilitate access to structured risk information and ensure risk transparency through enterprise-wide visibility. Real-time information for decision-making can promote new opportunities, and can assist in rationalizing efforts, thereby reducing cost.

Traffic statsUnderstanding how does a gps speedometer

You might also like

|

Enterprise Risk Management - Straight to the Point: An Implementation Guide Function by Function (Viewpoints on ERM) Book (CreateSpace Independent Publishing Platform)

|

Stock Update (NASDAQ:CTSH): Cognizant to Present at Investor Conferences

— Jutia Group

.. operations improvement consulting, strategy consulting, and business consulting services; and application design and development, systems integration, enterprise resource planning, and customer relationship management implementation services.